Best Mutual Fund Application for Android Users|2019

|

| Best Mutual Fund Application for Android Users |

Mutual funds have now become the go to saving and

investment option across India. This can be attributed several factors

including rising awareness due to popular ‘Mutual Funds Sahi Hai’ campaign,

increased internet penetration, rise of equity markets, and so on. Having

understood the benefits of investing regularly in mutual funds, people are

exploring and looking out for best platforms and advisers to invest in mutual

funds.

Investing

in mutual funds is now simple and free. No paperwork, no hassles. Invest in the

best mutual funds using Groww. All mutual funds are available in one investment

app. And the best part - invest in direct mutual funds with zero commission for

free. Switch your regular investments to direct.

Groww

is a mutual fund investment platform that helps the first-time investor to get

started with investing in 2 minutes and the entire process is paperless and

seamless including KYC. Groww helps the investor to get better returns when

compared with Fixed Deposit returns or savings account. As a first time

investor, you can invest in liquid funds or ultra-short term debt funds for

short-term or invest in equity funds for long term. All mutual funds are

available in one investment app/platform and the investor can invest in

balanced funds, gold funds, sector funds, tax-saving funds, or international

funds whatever they like and later on they can sell off their investments

anytime without any issues or hassle and all the money transactions will come

directly to your bank account.

The

first time investor should be aware of that there are two types of mutual funds

plans available – Direct and Regular. The Regular Plan works on the commission

model where the commission will be paid to the distributors and results in low

returns whereas the Direct Plan result in higher returns and there is no

commission. As mentioned above, the whole process is paperless and one can buy

any Direct Plan within minutes and you will be happy to know that there are no

charges for investing in Direct Plans through Groww .

Even those who have already invested in the Regular plans through any agent or platform, can

move their investments to Direct plans and can start saving on the commissions,

right way.

Groww App Steps

Step 1: Download the “Groww App” from Google Play

Store and install.

Step 2: Now the app installed on your device and as soon as

you tap on “Groww App” it will ask you to register on the app and Sign-in if

you already have an account.

Step 3: This is a one time process where you have to share

all your details, basically a KYC process.

Step 4: Now you have shared all the details, it’s time to

get started with investing. All you have to do is select any mutual fund and

verify your KYC. Once all done, you can start SIP or

one-time lump-sum investment.

Safety and Security

Groww uses the latest

security standards to keep your details safe and they use BSE (Bombay Stock

Exchange) Star platform for transactions and supports all RTAs; CAMS, Karvy,

Sundaram and Franklin. Additionally, you can check your units on mutual fund

apps in India like Mycams, Camsonline and Karvy. You can also switch your funds

to Groww without any charges.

Features of Groww App

Invest

in mutual funds online - free

- Zero Fees, No transaction charges

- All direct mutual funds - earn upto 1.5%+ returns

- Sell anytime - money comes to your bank account directly

- Learn to invest in mutual funds with as low as Rs 500

- Switch to direct funds for free

- Zero Fees, No transaction charges

- All direct mutual funds - earn upto 1.5%+ returns

- Sell anytime - money comes to your bank account directly

- Learn to invest in mutual funds with as low as Rs 500

- Switch to direct funds for free

Mutual fund investing for you

- Simple design, built with beginners and experts in mind

- Invest in the ready-made basket of mutual funds recommended by experts

- View beautifully designed charts, and historical performance of any mutual fund

- Top mutual funds list for different categories

- Latest finance news and insights

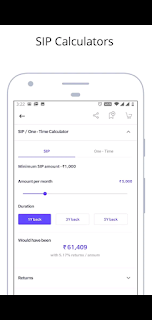

Mutual fund tracking and analysis

- Dashboard to track all your investments

- Track your annualized returns and total returns

- Check details of holdings and mutual fund NAV like Moneycontrol and Valueresearchonline

- Calculate returns through mutual fund SIP calculator

- Track your existing investments outside Groww

All mutual fund companies (AMCs) are

supported on Groww Mutual Fund app including:

SBI Mutual Fund

Reliance Mutual Fund

ICICI Prudential Mutual Fund

HDFC Mutual Fund

Aditya Birla Sun Life Mutual Fund

Franklin Templeton Mutual Fund

DSP Blackrock Mutual Fund

Kotak Mutual Fund

Mirae Asset Mutual Fund

Axis Mutual Fund

Motilal Oswal Mutual Fund

L&T Mutual Fund

IDFC Mutual Fund

Parag Parikh Mutual Fund

UTI Mutual Fund

Sundaram Mutual Fund

Tata Mutual Fund

Reliance Mutual Fund

ICICI Prudential Mutual Fund

HDFC Mutual Fund

Aditya Birla Sun Life Mutual Fund

Franklin Templeton Mutual Fund

DSP Blackrock Mutual Fund

Kotak Mutual Fund

Mirae Asset Mutual Fund

Axis Mutual Fund

Motilal Oswal Mutual Fund

L&T Mutual Fund

IDFC Mutual Fund

Parag Parikh Mutual Fund

UTI Mutual Fund

Sundaram Mutual Fund

Tata Mutual Fund